Fiscal justice

Showing 1 to 30 of 184 results

New guide: Decoding Gender Injustice

This guide unpacks how global economic policies entrench inequality and provides tools to challenge them. It equips movements to expose systemic harms and push for economic rules that center care, equity, and dignity.

Cautious consensus: Where we stand on the Compromiso de Sevilla

Despite deep divisions, the Compromiso de Sevilla opens space for long-overdue reforms in global economic governance. This blog unpacks what was gained, what was lost, and how civil society and Global South coalitions are pushing beyond compromise toward rights-based transformation.

Regional experts call for rights-centered international fiscal reform

As UN tax negotiations are set resume in a few months, a high-level dialogue in Santiago called for embedding human rights at the core of global and regional fiscal reform.

Technical note: Aligning tax cooperation with human rights in the UN Tax Convention

This technical note argues that international tax cooperation must be rooted in human rights obligations—especially economic and social rights—to ensure fairness, equity, and accountability. It offers practical guidance for embedding these principles into the UN Tax Convention, enabling a global tax system that supports sustainable development and reduces inequality.

CESR at FfD4 Prep Com 4: Driving rights-based finance and gender justice

Amidst escalating crises, our interventions highlighted the urgent need to reclaim public finance for people and planet, ensuring no one is left behind.

Protecting our common home and our shared humanity: Pope Francis’ legacy, the Jubilee and the way forward

As we enter the Jubilee year, we reflect on Pope Francis' unwavering advocacy for debt relief, tax justice, and a Rights-Based Economy.

States adopt UN resolution to further rights-enabling economic policies

The Human Rights Council’s new resolution on economic, social and cultural rights strengthens the link between human rights and fiscal policy

All roads lead to Seville: why FfD4 matters for civil society and economic justice

We have reviewed FfD4’s First Draft—the preliminary version of the Conference’s outcome document now under negotiation. Like many of our allies, we see some welcome progress, but remain concerned that it falls short of what’s needed to confront the deep structural inequalities shaping the global economy.

UN CESCR issues historic statement on tax and human rights

After CESR and allies urged the Committee to champion tax justice as a human rights imperative, the UN entity explained in detail the importance of fair and inclusive taxation for the realization of social rights.

Unpacking the first organizational session of the UNTC: progress towards a just global tax system

The first organizational session of the Intergovernmental Negotiating Committee for the UN Tax Convention has concluded with significant progress toward just and inclusive global tax governance.

New guide: How to influence the G20 agenda for Economic Justice

Our latest publication provides actionable insights and strategies for advocating within and beyond the G20 system.

The UN Tax Convention Terms of Reference have been approved. What’s next?

In a historic moment for global fiscal justice, the United Nations General Assembly approved the Terms of Reference (ToR) for the UN Tax Convention on November 27. This decisive outcome signals a global commitment to addressing inequalities, curbing tax abuses, and ensuring a fairer distribution of resources, and promoting inclusivity worldwide.

Will the “Finance COP” live up to the expectations? A critical analysis of the stakes at COP29

As COP29 approaches in Baku, the summit billed as the “Finance COP” raises critical questions about the global commitment to climate finance. ESR examines the stakes, from financing adaptation and loss to reforming global debt structures and taxing climate damage.

CESR and allies put forward key proposals for FfD4 to build a rights-based financial future

As the countdown to the Fourth Conference on Financing for Development (FfD4) in Seville 2025 begins, CESR joins forces with civil society to put forward a powerful agenda for financial transformation.

Relive “Privacy vs. transparency: Human rights and the UN Tax Convention”

On October 22, CESR hosted a webinar addressing the complexities of privacy, transparency, and human rights in the context of global tax reform.

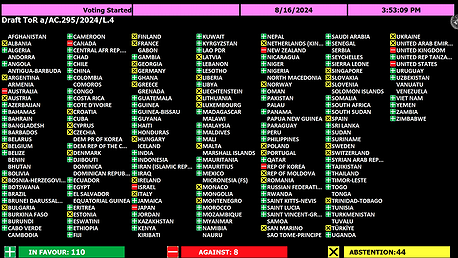

The adoption of the UN Tax Convention Terms of Reference paves the way for Fiscal Justice

Adopted by 110 votes to 8, the Terms of Reference include human rights as a core principle.