Corporate tax

Showing 1 to 30 of 33 results

Setting the stage: an in-depth analysis of the 103 submissions to the UNTC

Here, we analyze the key demands and issues that member states and other relevant stakeholders are putting on the table.

OECD’s tax deal may discriminate on the basis of gender and race - UN experts warn

Following a joint submission by CESR and allies, UN Experts have warned of the potentially discriminatory impact of the OECD’s “Two Pillar Solution”.

Analysis of Ongoing Consultations: Why we urgently need to join forces towards supporting a UN Tax Convention

The inputs received by the UN's Secretary General ahead of discussing a UN Tax Convention show how urgent it is to join forces to make the instrument happen.

Taking a critical look at the OECD Global Tax Agreement through a human rights lens

CESR participated in a two-day workshop in Tunis on the OECD’s Global Tax Agreement, hosted by the Tunisian Observatory of the Economy and Tax Justice Network Africa.

Half Measures: Global Digital Tax Proposals Fall Short of Realizing Human Rights

In this working paper, we analyze the human rights impacts of proposals to tax digital multinationals.

CESR's Submission to UN’s Independent Expert on Foreign Debt

We urge Prof. Attiya Waris to investigate the linkages between rising debt, tax systems, governance, and climate action.

Platforming Workers’ Rights in Global Tax Deals

Will the new “global solutions'' being proposed for taxing multinationals align with workers’ rights? In this new post, we analyze the links between global tax deal proposals and the lives of platform workers.

CESR Underscores How Human Rights Obligations Can Support Feminist Taxation

CESR Director of Program Kate Donald spoke as part of the "Framing Feminist Taxation" webinar organized by the Global Alliance for Tax Justice and ActionAid.

Tax Reforms and Global Redistribution: Situating the Global South

In this commentary piece for Economic & Political Weekly, our Program Officer, Sakshi Rai, argues for an urgent overhaul of the international financial system, as it continues to undermine workers' rights.

Global Minimum Tax: G7 Agreement Lacks in Legitimacy, Fails to Tackle the Root of the Problem

A truly progressive global tax reform must aim for the fair allocation of taxing rights for Global South countries, challenging the colonial foundations of the international financial system and giving all countries an equal seat at the table.

Organizations in Latin America Call on the Colombian Government to Put an End to Violence Against Protestors

CESR supports the call of organizations from throughout the region demanding that Colombian authorities guarantee citizens’ rights to mobilize peacefully and take part in fiscal debates.

CESR's Kate Donald Discusses Tax Biases Against Women and the Global South

"Taxation for Redistributive Justice: Solutions for Women, People and Planet" discussed tax policy biases that negatively impact women and other disadvantaged groups, as well as countries of the Global South.

Speaking Truth to Power: Growing the Movement to Fight Inequality

Stark power imbalances are fueling extreme global inequality and cross-movement alliances within civil society are needed to combat the problem.

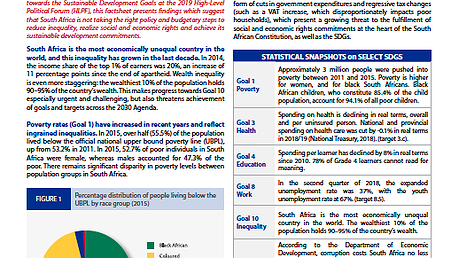

South Africa: Is Resource Mobilization Reducing Inequality?

As South Africa presents its review at the High-Level Political Forum (HLPF) in New York, a rights-based snapshot of obstacles and opportunities is put forward by CESR, the Institute for Economic Justice and Section 27.

New Human Rights and Fiscal Justice Initiative Calls for Global Corporate Tax Reforms

The Initiative for Human Rights Principles and Guidelines in Fiscal Policy in Latin America is demanding radical changes to the rules of global taxation in order to stop tax avoidance and the race to the bottom in corporate tax rates.

CESR allies with ICRICT to re-envision international corporate tax rules

ICRICT, an independent, nonpartisan group of global tax experts, seeks to reform the international corporate taxation system by fostering a broad-based, inclusive discussion of the rules governing how multinationals are taxed.

%20_2.png.458x258_q85_box-0%2C2%2C703%2C397_crop_detail.png)

South Africa urged to end austerity measures amid "unacceptably high levels of inequality"

Civil society inputs documenting rights deprivations in health, education, tax policies were crucial to CESCR recommendation.

Tax abuse leads to human rights abuse

Policy-makers have played Jenga with the broken international corporate tax system for some time. It’s time to build a new foundation for effective taxation of multinationals.

Kathryn Sikkink book cites CESR's call for a "tax policy for human rights"

Media: Human rights expert writes that CESR stands out when citing tax havens as a drain on available resources that could provide adequate economic and social rights.

U.S. Tax Plan’s Spiraling Consequences for Human Rights and Poverty – At Home and Abroad

Media: CESR's Niko Lusiani writes in FACTCoalition about CESR bringing the human rights costs of the proposed U.S. tax cuts to the attention of leading UN human rights official Philip Alston now investigating poverty in the country.

U.S. Tax Plan’s Spiraling Consequences for Human Rights and Poverty – At Home and Abroad

CESR's Niko Lusiani writes in FACTCoalition about CESR bringing the human rights costs of the proposed U.S. tax cuts to the attention of leading UN human rights official Philip Alston now investigating poverty in the country.

CESR raises concerns about US tax bill before UN human rights and poverty expert visiting the country

6 December: CESR Statement: As U.S. Congress considers drastically altering its tax code, CESR presented human rights costs of proposed cuts to the attention of visiting UN human rights and poverty official.

CESR submission to UN Special Rapporteur warns of proposed U.S. tax plan's ill effects on human rights

CESR submission asserts that pending U.S. tax plan deepens inequalities in the U.S. and beyond.

Tax abuse and human rights: closing the gap between what’s legal and what’s just.

The Paradise Papers prompt a demand for an international convention ending cross-border tax abuse and financial secrecy. A transnational problem, tackling tax abuse requires a concerted global response.

Tax competition & avoidance "inconsistent with human rights"

Blog: New CESCR General Comment details governments’ legal duties to prevent and address the adverse impacts of corporate tax avoidance on human rights.

Corporate taxation key to protecting human rights in the global economy

UN expert body takes new steps to prevent corporate tax abuses, but more is needed to ensure companies pay their fair share.

Strictly business: national rights institutions and the private sector

National Human Rights Institutions (NHRIs) have a critical part to play in making sure the private sector be called to account for its impact on human rights.

FTT: Robin Hood advocates undeterred by challengers

Blog: Momentum towards the implementation of a financial transactions tax in Europe is facing new obstacles. With success seeming so close yet so far, campaigners are redoubling their efforts.

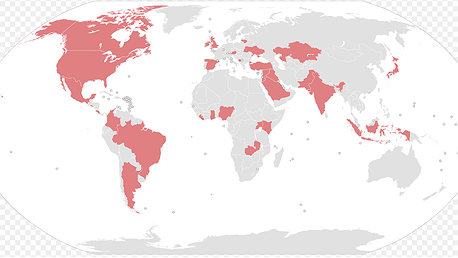

Europe moves forward on Robin Hood Tax while US balks

The 'Robin Hood Tax' has come one step closer after 11 European countries agreed to move forward with the initiative. Certain key states, including the US, remain opposed, however.