For the first time, the G20 Finance Track has directly received recommendations from civil society organizations, marking a historic moment in international tax policy discussions.

At the G20 International Tax Symposium, Nathalie Beghin from INESC (one of our partners at the Initiative for Human Rights in Fiscal Policy) presented a document with 11 key recommendations on behalf of civil society to Brazil's Finance Minister, Fernando Haddad. These recommendations aim to guide G20 Finance Ministers towards more equitable and just international tax policies.

This groundbreaking initiative, led by Brazil’s G20 presidency, invited civil society to contribute directly to the dialogue on international taxation which took place in Brasilia on May 22 and 23, 2024, to discuss issues such as the building of a United Nations Convention on Tax, and an international approach to tax wealth. The recommendations were developed collectively by over 40 national, Latin American, and international organizations, reflecting a broad consensus on the need for inclusive and fair tax systems.

To María Emilia Mamberti, CESR’s Co-Director of Program, “This signifies a huge milestone in the efforts of the human rights movement to connect tax and rights. It moved debates in the right direction to understand taxation not as a technical issue only pertaining to “tax payers”, but as a key instrument to enhance living standards for all rights holders”.

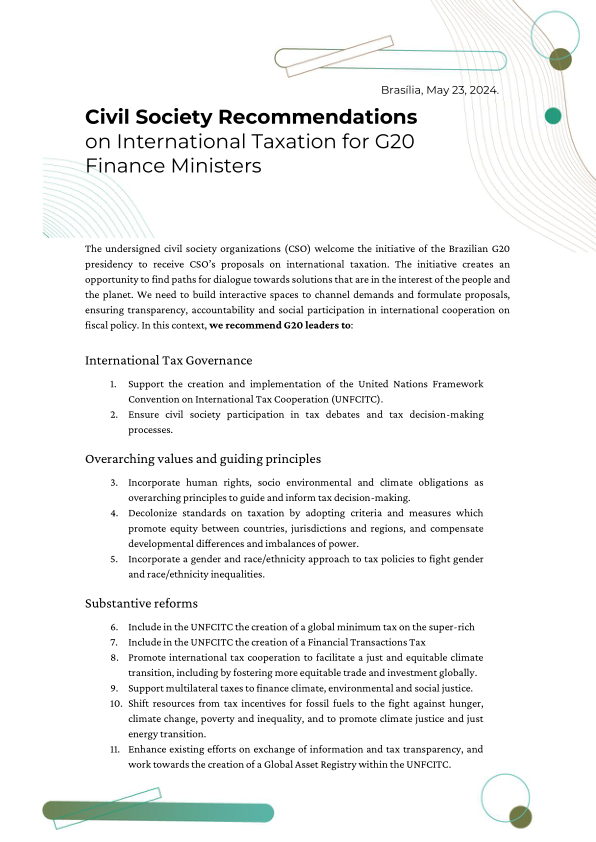

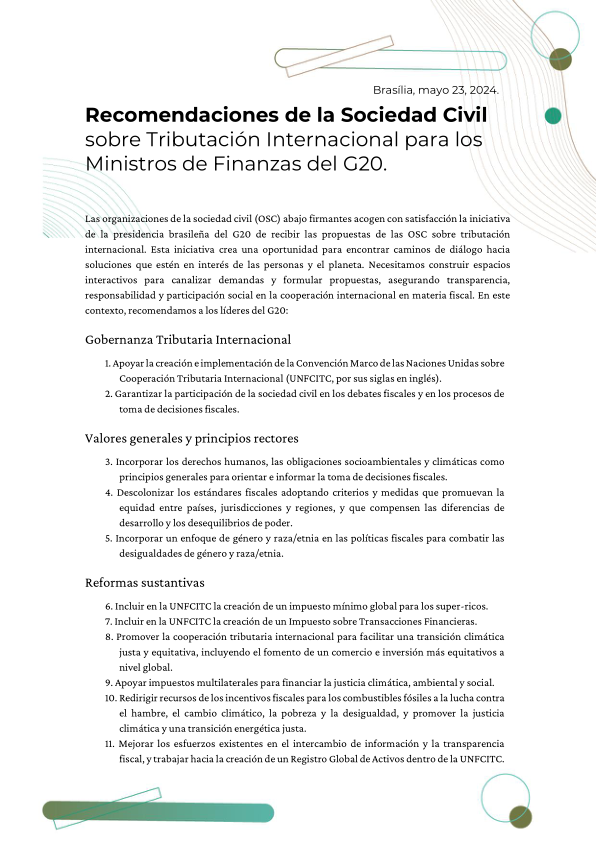

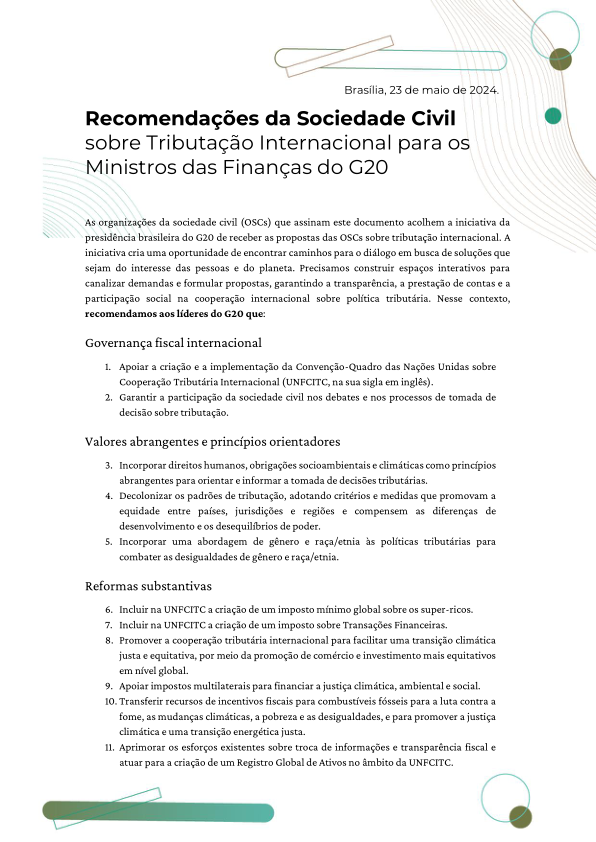

The full document detailing the Civil Society Recommendations on International Taxation for G20 Finance Ministers is available in Portuguese, English, and Spanish.

Key Recommendations Include:

Governance of International Taxation:

-

Support the creation and implementation of the United Nations Framework Convention on International Tax Cooperation (UNFCITC).

-

Ensure civil society participation in tax debates and decision-making processes.

General Values and Guiding Principles:

-

Incorporate human rights, socio-environmental, and climate obligations as general principles to guide tax decision-making.

-

Decolonize tax norms, adopting criteria and measures that promote equity among countries, jurisdictions, and regions, and compensate for development disparities and power imbalances.

-

Incorporate a gender and race/ethnicity approach in tax policies to combat inequalities.

Substantive Reforms:

-

Include the establishment of a global minimum tax on the super-rich in the UNFCITC.

-

Create a Financial Transactions Tax under the UNFCITC.

-

Promote international tax cooperation to facilitate a just and equitable climate transition, particularly through fairer global trade and investment.

-

Support multilateral taxes to finance climate, environmental, and social justice.

-

Redirect resources from fossil fuel tax incentives to combat hunger, climate change, poverty, and inequality, and to promote climate justice and a just energy transition.

-

Strengthen efforts in information exchange and tax transparency, and work towards establishing a Global Asset Registry under the UNFCITC.

The seminar, organized by Brazil’s Ministry of Finance at the University of Brasilia, is a milestone in the fight for tax justice, demonstrating civil society's commitment to influencing public policies significantly and responsibly.

Read the full document with Civil Society Recommendations on International Taxation for G20 Finance Ministers: