African governments have taken another significant step to reform global tax rules by proposing a process to establish a UN Tax Convention. Nigeria, on behalf of the African Group, tabled a draft resolution, which, if adopted by the General Assembly, would set up an intergovernmental committee to elaborate a comprehensive new treaty on international tax cooperation by 2025. Such a reform is highly overdue and necessary to mobilize maximum available resources for the realization of human rights.

“A UN Convention on Tax is critical for all countries, but especially for low and middle-income countries, to be able to increase revenues to realize human rights and address global crises such as the climate crisis. The African Group resolution requires strong support from all countries and movements who want to increase the fiscal space of governments to increase spending on public services, to reduce inequalities, and for just climate action,” said Dr. Maria Ron Balsera, CESR’s Director of Program.

There is overwhelming evidence in support of the need for reform of international tax rules. Unjust tax systems fuel rising inequality and widen disparities in human rights enjoyment. Despite a commitment from the G-20 and OECD to crack down on multinational companies’ use of tax havens, $480 billion is still lost to global tax abuse every year. Weaknesses in international tax rules have resulted in increasing inequality, and the richest 1% accumulate nearly twice as much wealth as the rest of the world put together. It also results in reduced fiscal space for countries, in a context where they are struggling to tackle multiple global crises, and reduced resources for public services and climate adaptation and mitigation.

The OECD’s Inclusive Framework “to level the playing field” (which started in 2016), with its two pillars, has been a missed opportunity and will only raise a minuscule amount of revenues for low and middle-income countries. In exchange, however, these countries are required to give up their rights to impose other forms of taxation, such as progressive digital services taxes, which will reduce rather than increase their fiscal space to realize rights. The process of development of the Inclusive Framework has also been critiqued for its lack of transparency and meaningful participation of all countries.

Finance ministers in the European Union have suggested that their governments support a weaker non-binding option, which will allow for increased coordination between countries, but not support a new international tax framework because it would duplicate the OECD’s Inclusive Framework.

“Governments have obligations under international human rights treaties to cooperate internationally to increase resources for the realization of economic, social, and cultural rights for all. This requires that all governments, including European governments, support reforms to international tax rules to increase the fiscal space of all countries to realize rights and to urgently stop illicit financial flows and other tax abuses,” said Maria.

Background

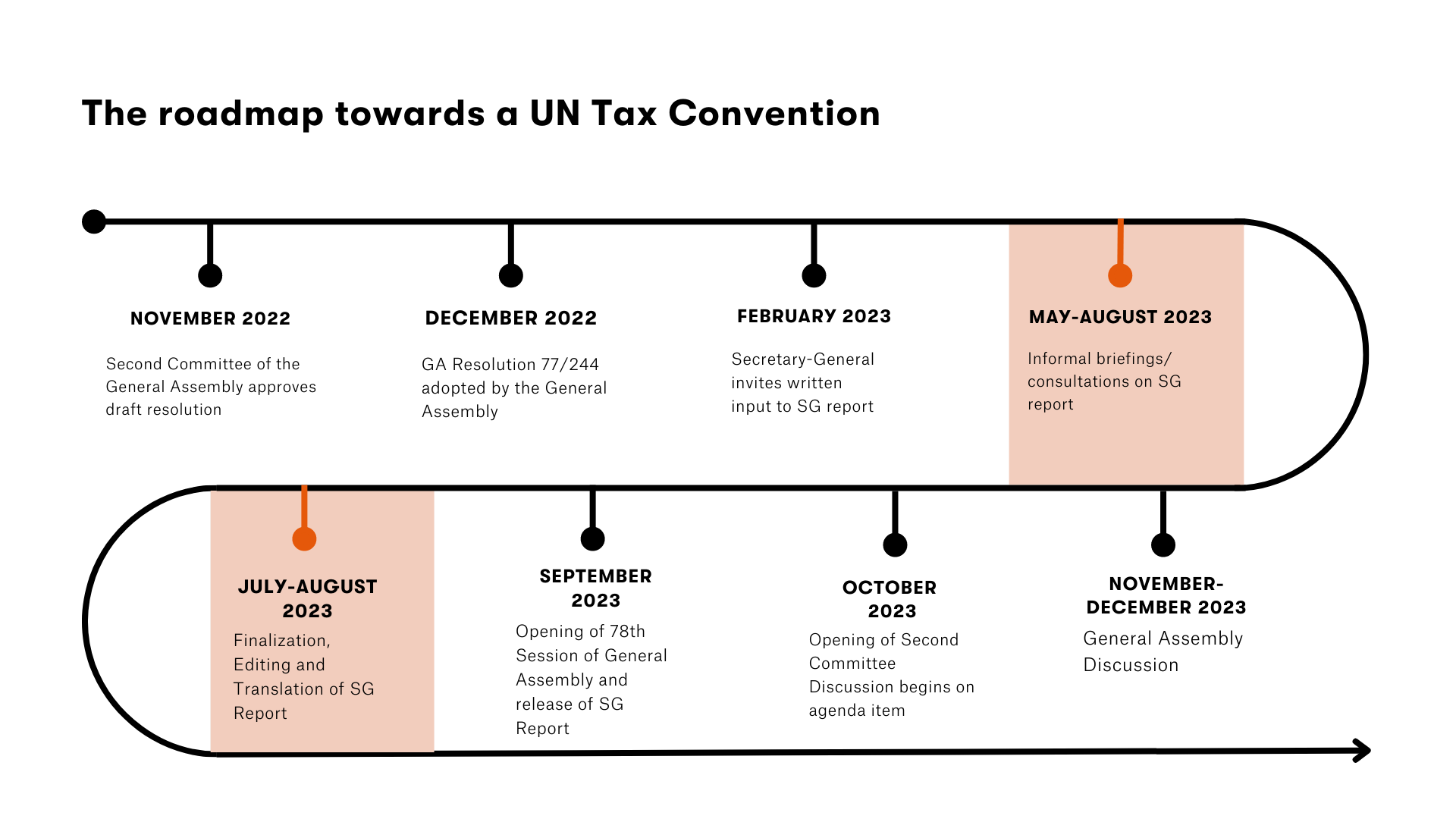

As a result of groundbreaking efforts by African Countries, the United Nations General Assembly adopted a resolution on the promotion of inclusive and effective international tax cooperation in December 2023. The resolution required the UN Secretary-General (UN SG) to prepare a report analyzing existing arrangements, identifying additional options, and outlining potential next steps. Prior to the drafting of his report, the UN SG published a call for inputs which received 92 submissions in total from member states and relevant stakeholders, and conducted informal consultations.

The UN SG’s report concluded that the OECD process does not enable effective “participation, agenda-setting and decision-making” for all countries concerned. To this end, the report elaborates that an inclusive and effective forum would require procedures that “take into account the different needs and capacities of all countries to meaningfully contribute to the norm-setting processes, without undue restrictions, and support them in doing so.”

The report concluded that enhancing the UN’s role in “tax-norm shaping and rule-setting, with full consideration of existing multilateral and international arrangements, appears the most viable path for making international tax cooperation fully inclusive and more effective.” It also stated that rather than duplicating existing processes, “a United Nations intergovernmental process would leverage existing strengths and address gaps and weaknesses in current international tax cooperation efforts.” It identified options for consideration that would need to be developed and agreed upon through a UN member state-led process: Nigeria, on behalf of the African Group, has proposed a comprehensive convention that is currently under consideration at the UN General Assembly’s Economic and Financial Committee (Second Committee). The Second Committee is scheduled to conclude its work by 22 November 2023.