In a historic moment for global fiscal justice, the United Nations General Assembly approved the Terms of Reference (ToR) for the UN Tax Convention on November 27. Only 9 countries opposed transformative changes in the international tax system: the United States, United Kingdom, Canada, Australia, Israel, Japan, Korea, Argentina, and New Zealand, while an overwhelming majority of 125 nations voted in favor. This decisive outcome signals a global commitment to addressing inequalities, curbing tax abuses, and ensuring a fairer distribution of resources, and promoting inclusivity worldwide.

.png)

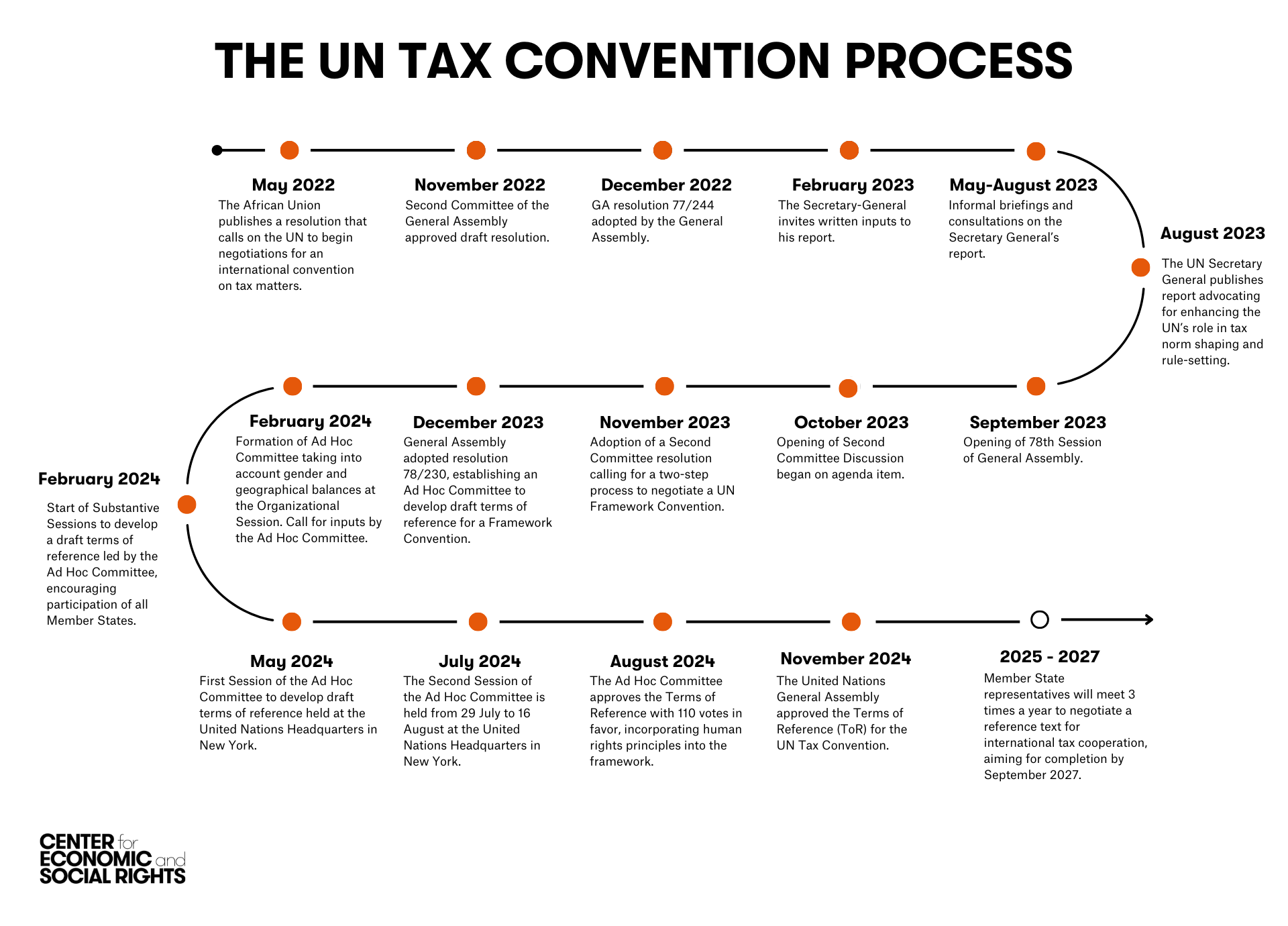

Starting in 2025, representatives from Member States will meet three times a year to negotiate the text that will serve as a reference for international tax cooperation, with a target completion date of September 2027.

The negotiation process will likely address a range of issues, as different regions and stakeholders push for their key priorities . Discussions may include protocols on issues such as illicit financial flows (prioritized by the African group), taxation of high-net-worth individuals (championed by Brazil and supported by other Latin American countries), and mechanisms for exchange of information. While specific proposals are still evolving, it will be crucial to balance diverse perspectives and build consensus around protocols that advance equity and inclusivity. Flexibility in the approach, including protocols appealing to various regions and interest groups, will be essential to ensuring broad participation and support for the final framework.

The negotiation process will likely address a range of issues, as different regions and stakeholders push for their key priorities . Discussions may include protocols on issues such as illicit financial flows (prioritized by the African group), taxation of high-net-worth individuals (championed by Brazil and supported by other Latin American countries), and mechanisms for exchange of information. While specific proposals are still evolving, it will be crucial to balance diverse perspectives and build consensus around protocols that advance equity and inclusivity. Flexibility in the approach, including protocols appealing to various regions and interest groups, will be essential to ensuring broad participation and support for the final framework.

Either way, the landslide approval of the resolution to negotiate (November 2022), followed by the resolution to draft terms of reference (December 2023), and now the approval of these terms of reference (November 2024), marks a historic shift. This transition moves tax cooperation and decision-making from the OECD to a multilateral, inclusive, and democratic forum at the United Nations. The inclusion of International Human Rights Law in the terms of reference is crucial for ensuring that tax negotiations and cooperation are fair, equitable, and transparent, aligning with principles of gender equality and non-discrimination.

Dr. María Ron Balsera, CESR’s Executive Director, stated: “The overwhelming majority supporting the adoption of the terms of reference for the UN Framework Convention on Tax Cooperation signals a turning point. It challenges the unfair international financial architecture tainted by colonial legacies and corporate dominance. This multilateral forum fosters inclusion, participation, transparency, development, and human rights. The power of the Global South in these negotiations will resonate for decades, influencing debt restructuring and trade agreements worldwide.”

CESR will persist in advocating for progressive taxation to mobilize the maximum available resources necessary to meet economic and social rights obligations, including extraterritorial obligations and the responsibilities of other countries in enabling or impeding domestic resource mobilization.

Are you curious about what this means and how the process will unfold? Dive into our UN Tax Convention FAQs to explore the details and implications of this historic moment.