A reflection on International Human Rights Day from our Executive Director, Dr. Maria Ron Balsera.

On Human Rights Day, our world faces a stark reality: the principles enshrined in the Universal Declaration of Human Rights (UDHR) are under siege in far too many corners of the world. From the relentless wartime violations in Palestine, Lebanon, Ukraine, and Yemen to the climate and debt polycrisis robbing countless citizens of their economic and social rights in the Global South, the UDHR’s promises of dignity, non-discrimination, participation, transparency, accountability, and the rule of law remain unfulfilled for billions. That is why over 75 years after its signing, the UDHR’s vision of universal rights feels more urgent than ever.

Emerging from the geopolitical tensions at the onset of the Cold War, the UDHR was a groundbreaking compromise between competing ideas for a just world. Western powers emphasized civil and political liberties–freedoms from oppression and interference–while nations in the Eastern bloc and those overcoming colonial rule championed economic, social, and cultural rights grounded in equity and opportunity. This unique blend of aspirations gave rise to the indivisible and inalienable framework we recognize today–one that guarantees not just individual rights but collective ones, addressing environmental justice, cultural preservation, and an economy that works for the many instead of the few.

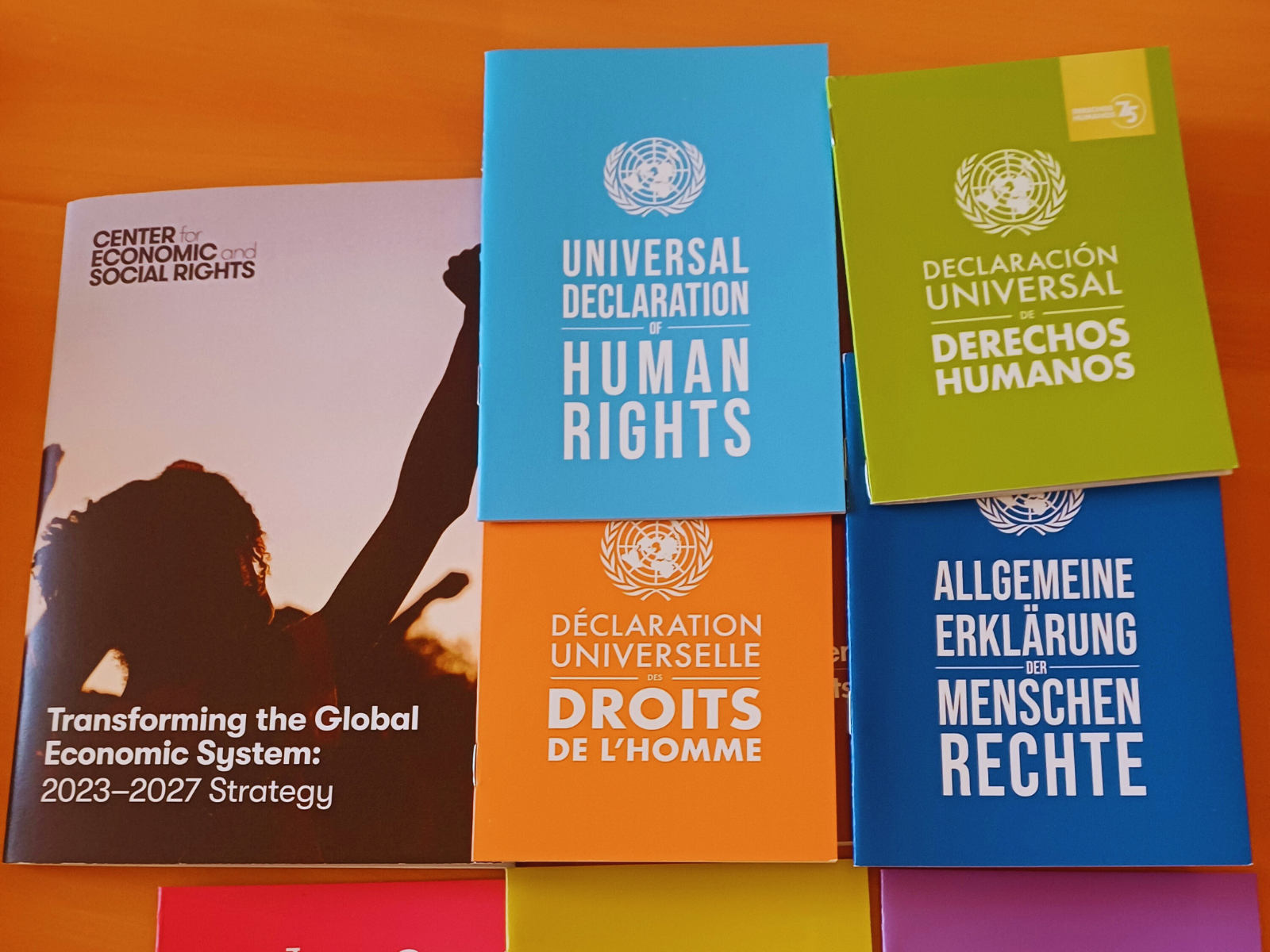

Yet, as we mark this anniversary, we must confront a harsh truth: human rights–especially economic and social rights–remain vastly underutilized as tools for achieving an equitable world. The potential of these rights to challenge entrenched power imbalances and redistribute resources is immense but largely untapped. For over three decades, the Center for Economic and Social Rights (CESR) has sought to wield this power, working to build a world where dignity is not a privilege for a wealthy few but a birthright for all. By leveraging human rights frameworks, CESR seeks to inspire more equitable and sustainable economies–where resources and power are allocated justly, enabling current and future generations to thrive.

Of course, these economic and social rights do not exist in a vacuum. They require resources to be fulfilled. Yet, an estimated $490 billion is lost to tax abuse every year. These staggering losses undermine governments’ ability to fund public services essential for realizing education, healthcare, and housing. Tax havens and loopholes enable wealthy corporations and individuals to dodge their responsibilities and exacerbate inequality, depriving societies of the fiscal means to secure basic human dignity.

This is not a problem of one individual country or actor. It is a global issue rooted in the interdependence of economies and the extraterritorial obligations of states. According to these extraterritorial human rights obligations, states must abstain from conduct that undermines another state’s capacity to fulfill their own obligations. This means that when one state facilitates tax abuse or engages in aggressive tax competition, it violates human rights law. The resulting “race to the bottom” erodes national fiscal capacities and stifles progress towards equality.

Only last month, in a historic moment for global fiscal justice - with ramifications in terms of decolonization of the international financial architecture - the United Nations General Assembly approved the Terms of Reference (ToR) for the UN Tax Convention. With an overwhelming majority of 125 nations voting in favor, against 9, this decisive outcome signals a global commitment to addressing inequalities, curbing tax abuses, and ensuring a fairer distribution of resources, and promoting inclusivity worldwide. Our team and allies from international civil society fought hard (and succeeded) to incorporate human rights into the Convention’s guiding principles. At the G20 in Brazil, leaders expressed their will to tax billionaires, reverting decades of free riding that has resulted in growing inequalities. The role of CSO, including CESR’s role in the T20 and C20, was fundamental to achieve this historical declaration

We will continue to support these processes closely to ensure that human rights standards are integrated into taxation and other reforms of the global financial architecture. Framing international tax cooperation through a human rights lens is key for adopting a holistic, sustainable development approach that addresses inequality, environmental issues, health, gender equality, and intergenerational aspects. We believe that human rights mechanisms provide crucial guidance for dismantling past and current injustices and building transparent, inclusive mechanisms for the future.

Finally, as we commemorate Human Rights Day, let’s remember that securing rights is not just about opposing violations, but building systems that empower everyone to thrive. Resourcing rights means reshaping economies to prioritize people and the planet over profit and plunder. At CESR, we will continue to harness the power of human rights to inspire fairer and more sustainable economies. The time to act is now, let’s join forces to achieve a just distribution of resources and power that enables current and future generations to live with dignity, in full enjoyment of their economic and social rights.